Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Brackets that have 4, 8, 16, 32, or 64 teams participating in a single elimination tournament allows half the field to be eliminated in each round up until there's only one undefeated left. Imagine that there are three tax brackets: Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate.

Imagine that there are three tax brackets:

Imagine that there are three tax brackets: Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Brackets that have 4, 8, 16, 32, or 64 teams participating in a single elimination tournament allows half the field to be eliminated in each round up until there's only one undefeated left. Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate.

Imagine that there are three tax brackets: Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. Brackets that have 4, 8, 16, 32, or 64 teams participating in a single elimination tournament allows half the field to be eliminated in each round up until there's only one undefeated left.

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer).

Brackets that have 4, 8, 16, 32, or 64 teams participating in a single elimination tournament allows half the field to be eliminated in each round up until there's only one undefeated left. Imagine that there are three tax brackets: Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate.

Brackets that have 4, 8, 16, 32, or 64 teams participating in a single elimination tournament allows half the field to be eliminated in each round up until there's only one undefeated left. Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Imagine that there are three tax brackets: Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate.

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer).

Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. Brackets that have 4, 8, 16, 32, or 64 teams participating in a single elimination tournament allows half the field to be eliminated in each round up until there's only one undefeated left. Imagine that there are three tax brackets: Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer).

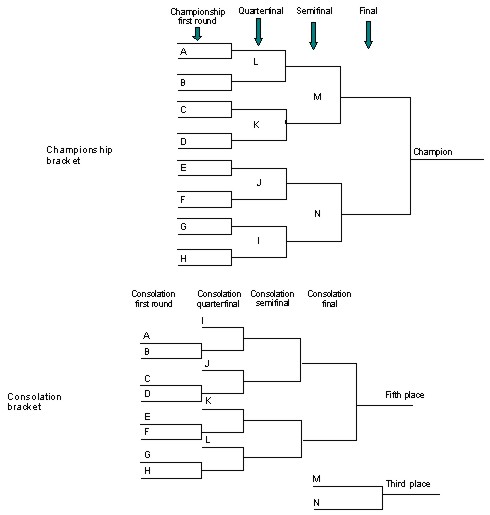

Top 16 Bracket Template : Double Elimination Tournament Wikipedia. Brackets that have 4, 8, 16, 32, or 64 teams participating in a single elimination tournament allows half the field to be eliminated in each round up until there's only one undefeated left. Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. Imagine that there are three tax brackets:

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer) 16 bracket template. Brackets that have 4, 8, 16, 32, or 64 teams participating in a single elimination tournament allows half the field to be eliminated in each round up until there's only one undefeated left.